is car loan interest tax deductible in india

Principal loan amount is not tax deductible and do not offer any tax benefit. May 10 2018.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return.

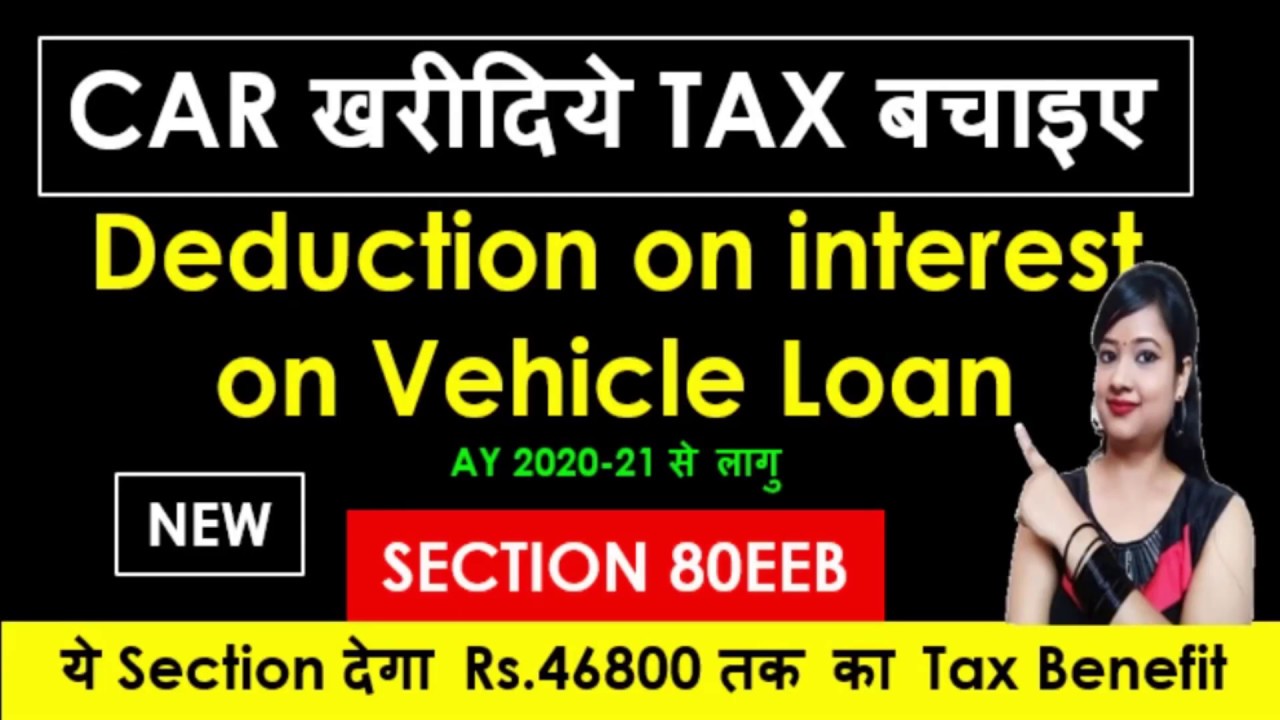

. This article is for discussing one of the most important tax incentives that the Government of India allows to the taxpayers. You can claim tax benefits only on interest. People who choose to acquire an EV on loan will be eligible for a tax deduction of Rs 15 lakh.

This means that if you pay. 10 Interest on Car Loan 10 of Rs. For instance assume you are a business owner and you.

Recently in Phillips India Ltd. In Indian context if the loan is taken for business than you can claim interest paid on mortgage loan as deduction from business profits. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns.

You cant claim deduction of car loan if its not an electric car in case of. Car loans availed by individual customers do not offer any tax benefit. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan.

As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. The benefit Section 80EEB can be claimed by individuals only. Both principal and well as interest paid on home loans is eligible for tax deduction.

Is car loan interest tax deductible in india. For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns. If its a loan for buying a commercial or.

The interest paid on a business loan is usually. Tax benefits towards home loan repayment are offered under section 80C of the Income Tax Act. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

Article continues below advertisement. How to show home loan interest for self occupied house in. Answer 1 of 2.

The student loan interest deduction allows you to deduct up to 2500 If you meet all of the eligibility criteria the maximum amount of interest you can deduct per year is 2500. The answer to is car loan interest tax deductible is normally no. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB. From FY 2020-2021 onwards tax incentives under Section 80EEB are available. The article talks about the deduction towards.

However for commercial car vehicle and. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes. When you file your taxes with the Internal.

This means that if you pay 1000. You can only claim car loan tax benefits on the interest and not the principal amount. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can.

Business loan interest amount is tax exempted.

Income Tax Imgur The Most Awesome Images On The Internet Income Tax Income Tax Return Tax Return

Personal Loan Tax Deduction Tax Benefit On Personal Loan Earlysalary

Personal Loan Tax Deduction Tax Benefit On Personal Loan Earlysalary

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits From Home Loans

Flat Interest Rate Vs Diminishing Balance Interest Rate Excel Based Calculator To Convert Between Flat Diminish Interest Rates Finance Guide Personal Loans

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Car Loan Interest Tax Deductible In The Uk

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Pin On Taxation And Business Software

Interest On Personal Loan Can Be Claimed As Income Tax Deduction In Some Cases Details Here Mint

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate