lake county real estate taxes due dates

Ringen Treasurer-Tax Collector 255 North Forbes St. Contact Us Treasurer-Tax Collector Barbara C.

Property Taxes In Nassau County Suffolk County

Monday May 2 2022 April 30 falls on Saturday January.

. County w Water Sewer- Tax Area 193. The property tax bill is provided 6 months in advance6 months in arrears for the full calendar year January to December 2022. All dates are subject to change.

Mailed payments must be postmarked no later than DECEMBER 12 2022. Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. TAXES PER 100000 ACTUAL VALUE 2021 Mill Levy City- Tax Area 114 112.

For contact information visit. If you have any questions about how much is owed on your taxes please give us a call 218 834-8315. Due dates for 2021 Payable 2022 Taxes.

707 263-2254 Email Us. Property tax payments are made to your county treasurer. First installment of real property taxes are due november 1 2022 and will be delinquent if not paid by december 12 2022.

Monday February 28 2022 and Second Installment. May 31st and November 30th. Property tax notices for 2022 were mailed at the end of May 2022.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Jordan Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B. Lake County Auditor 601 3rd Ave Two Harbors MN 55616.

Taxpayers who do not pay property taxes by the due date receive a penalty. Search Lake County Records Online - Results In Minutes. Notice Of Real Estate Tax Due Dates.

Property taxes become due and payable in January for the previous year. October 15th second half for commercial and residential property. Lake County 18 N County Street Waukegan IL 60085.

Rm 215 Lakeport CA 95453 Tax Collector. Find information about real and personal property tax dates at the Treasurers website. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax.

Ad Find Lake County Online Property Taxes Info From 2022. November 30th is the last day to pay current year property taxes without a penalty. Physical Address 18 N County Street Waukegan IL 60085.

Payments that are mailed must have a postmark of Wednesday February 1 5 202 3 or before by the United States Postal Service only. November 15th second half for agricultural. The collection begins on November 1st for the current tax year of January through December.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2023 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 10 2023. Monday - Friday 8am. The above referenced sale scheduled for September 13 2022 at 1000 AM has been postponed to October 18 2022 at 1000 AM in the Carlton County Sheriffs office 317 Walnut Avenue Carlton Minnesota in said County and State.

Postmarks from private mailing machines are no longer acceptable. 2022 Property Taxes are due July 4 2022. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone.

Taxpayers who do not pay property taxes. Current property tax due dates are. If the 30th lands on a holiday or weekend the due date is extended to the next business day.

May 15th first half for all real estate. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Real estate taxes are due in February and July of each year THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL PUBLIC TAXPAYERS CAN CONTINUE USING THE EXISTING DROP BOX AS AN ALTERNATIVE TO COMING IN NO CASH IN THERE PLEASE.

Notice is hereby given that Real Estate Taxes for the First Half of 2022 are due and payable on or before Wednesday February 15 2023. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Wednesday June 15 2022.

November 30th and May 31st. Property taxes are due twice a year. Due Dates for Property Taxes.

IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax. Due dates for property taxes are as follows.

10 hours agoNOTICE OF POSTPONEMENT OF MORTGAGE FORECLOSURE SALE. County- Tax Area 191. You will receive a statement with upcoming due dates in the Spring.

In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Real Estate Basic Facts Per Subdivisions Within Rosenberg Tx 77469 Basic Facts Richmond Tx Levee

/static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Understanding California S Property Taxes

Property Tax How To Calculate Local Considerations

Friendly Reminder For Those La County Property Owners Paying Their Property Taxes Directly Property Tax November 1 Pie Chart

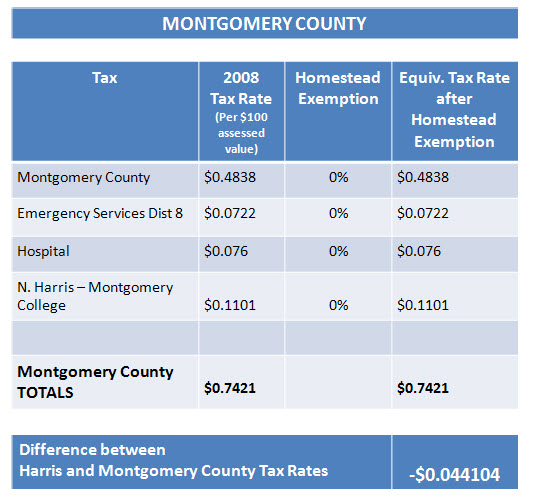

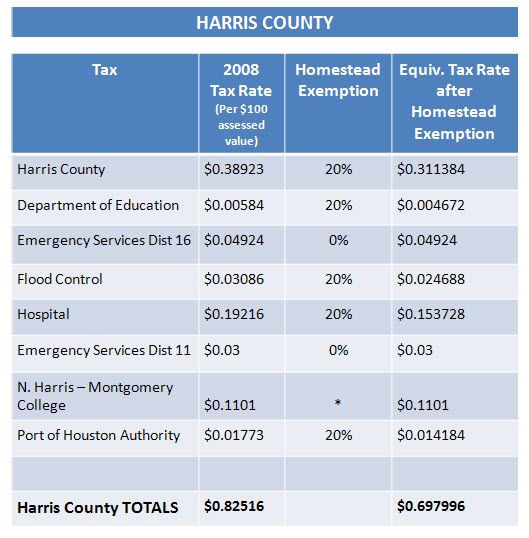

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

2021 Real Estate Tax Calendar Payable In 2022 Lake County Il

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

Pennsylvania Property Tax H R Block

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Risultato Della Ricerca Immagini Di Google Per Http Www Uppitorino It Immagin Property Tax House Outline Home Icon

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High Assessment The Neighbourhood Facts

North Central Illinois Economic Development Corporation Property Taxes